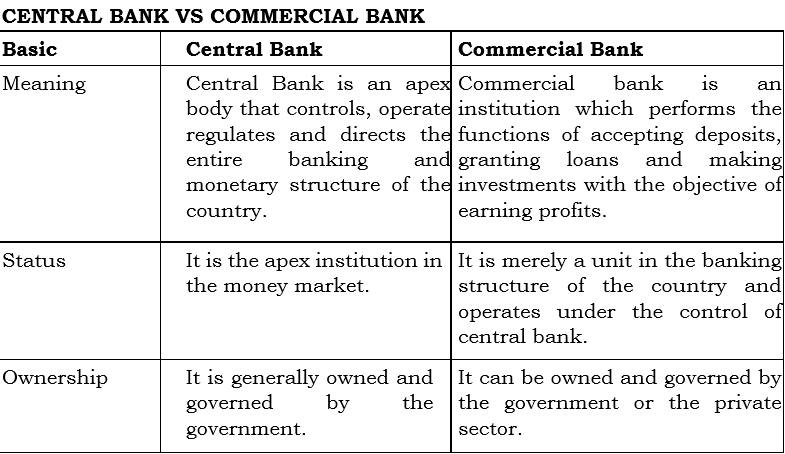

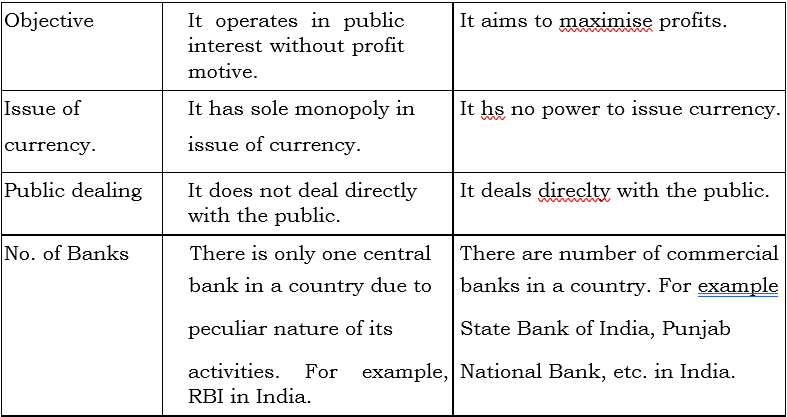

Commercial bank is an institution which performs the functions of accepting deposits, granting loans and making investments, with the aim of earning profit. State Bank of India (SBI), Punjab National Bank (PNB)

What is Banking

Banking means the accepting from the purpose of lending or investmetns of deposits of money from the public, repayable on demand or otherwise, and withdrawable by cheques, draft, order or otherwise. The two esential features of a bank are (i) Acceptance of chequable deposits from the public, and (ii)lending.

Define Commercial Bank : It is an institution which performs the function of accepting deposits, granting laons with the aim of earning profits.

DEFINE A BANK

‘Bank is an institution which borrows and lend money’. A bank receives deposits from those who want it to be kept safely and also earn some interest. In other words, it borrows money. It also lends money to merchants or manufacturer. Thus borrowing and lending of money are its two essential functions. Thus any institution which accepts deposit from the public with drawable by cheques and advance loans of various sorts is called a bank.

EXPLAIN FUNCTIONS OF COMMERCIAL BANKS

Function of commercial banks are as under :

1. Acceptance of Deposit : A commercial bank is a dealer in short term credit. It collects the surplus balance of the individuals and finances the temporary needs of commercial transactions. The first task is, therefore the collecting of the savings of the public. This the bank does by accepting deposits from its customers. Deposits are lifeline of bank. Deposits are of 3 types as under :

- CURRENT ACCOUNT DEPOSITS

Such deposits are payable on demand and are therefore, called demand deposits. These can be withdrawn by the depositors at any time. The bank does not pay any interest on these deposis but provides cheque facilities. These accounts are generally maintained by businessmen and industrialists who receive and make business payments of large amounts through cheques.

- FIXED TERM DEPOSITS

These are deposits for a fixed term, i.e., period of time ranging from a few days to a few years. These are neither payable on demand nor they enjoy

cheque facilities. They can be withdrawn only after the maturity of the specified fixed period. They carry higher rate of interest. They are not treated as a part of money supply.

- Saving account deposits. These are deposits whose main objective is to save. They combine the features of both current account and fixed deposits. The are payable on demand and also with drawable by cheque. But banks give this facility with some restriction i.e., allow only five or seven cheque in a month. The interest on these a/c is less the fixed a/c deposits.

2. It gives loans and advances. The second major function of a commercial bank is to give loans and advances particularly to businessmen and entrepreneurs and thereby earn interest. This is, infact, the main source of income of the bank. A bank keeps a certain portion of the deposits with itself as reserve and gives (lends) the balance to the borrowers as loans and advances in the following forms :

- Cash Credit : In this borrower is first sanctioned a credit limit and within that limit he is allowed to withdraw a certain amount on a given security. Interest is charged by the bank on the drawn or utilised portion of credit (loan).

- Demand Loans : A loan which can be recalled on demand is called demand loan.There is no stated maturity. The entire loan amount is paid in lump sum by crediting it to the loan account of the borrower.

- Short – term loans : Short – term loans are given against some security as personal loans to finace working capital or as priority sector advances. the entire amount is repaid either in one instalment or in a number of instalments over the period of loan.

Secondary Function / Other Functions : A part from the above mentioned two primary (major) functions, other functions performed by commercial banks are as follows :

- OVERDRAFT FACILITY

It refers to a facility in which a customer is allowed to overdraw his currency account upto an agreed limit. This facility is generally given to respectable and reliable customers for a short period. Thus, under this a depositor can get more than the amount of his current account deposits but he has to pay interest on the extra amount which he has to pay back eithin the short period.

- DISCOUNTING BILLS OF EXCHANGE OR HUNDIS

A bill of exchange is a document acknowledging an amount of money owed in consideration of goods received. It is a paper asset signed by debtor and

the creditor for a fixed amount payable on a fixed date. Suppose A buys goods from B, he may not pay B immediately but instead give B a bill of exchange stating the amount of money owed and the time when A will settle the debt. Suppose B wants the money immediately, he will present the bill of exchange (Hundi) to the bank for discounting. The bank will debuct the commission and pay to B the present value of the bill. When the bill matures after specified period, the bank will get payment from A.

AGENCY FUNCTION OF THE BANK

The bank acts as an agent for its customers and gets commission for performing agency functions as under.

- Transfer of funds. It provides facility for cheap and easy remittance of funds from place to place through demand drafts, mail transfers, telegraphic transfers etc.

- Collection of funds. It collects funds through cheques, bills, hundis and demand drafts on behalf of its customers.

- Payment of various items. It makes payment of taxes, insurance premium, bills etc as per directions of its customers.

- Purchase and sale of shares and securities. It buys, sells and keeps in safe custody securities and shares on behalf of its customers.

- Collection of dividends, interst on shares and debentures are made on behalf of its customers.

- Financing of foreign trade. Commercial banks finance the foreign trade of the country by accepting or collecting bills of exchange drawn by customers.

- Performing General Utility Services. The bank provide many general utility services. Some of which are as under :

- Issue of traveller’s cheques and gift cheques.

- Locker facility. The customers can keep their ornaments and impotant documents in lockers for safe custody.

- Underwriting securities issued by government public or private bodies.

- Purchase and sale of foreign exchange (Currency).

- Letters of credit are issued by the banks to their customers.

MONEY CREATION OR CREDIT CREATION

It is one of most important activities of commercial banks. Through the process of money creation, commercial banks are able to create credit, which is in far excess of the initial deposits.

The deposits held by Banks are used for giving loans. But banks cannot use the whole of deposits for lending. It is legally compulsory for the banks to keep a certain minimum fraction of their deposits as reserves. The fraction is called the Legal Reserve Ratio (LRR) and is fixed by the central bank. Banks do not keep 100% reserves against the deposits. They keep reserves only to the extent indicated by the Central Bank.

Why only Fraction of deposits are kept as Cash Reserves?

Banks keep a fraction of deposits as Cash Reserves because a rational banker, by his experience, know two things :

- All the depositors do not approach the banks for withdrawal of money at the same time and also they do not Withdraw the entire amount in one.

- There is a constant flow of new deposits into the banks.

Let us now understand the process of Money Creation through an example :

- Suppose, initial deposits in banks is Rs. 1000 and LRR is 20%. i.e. banks keeps only Rs. 200 as cash reserve and are free to lend Rs. 800. But banks do not lend this money by giving amount in cash, Rather, they open the accounts in the names of borrowers, who are free to withdraw the amount whenever they like.

- As all the transactions are routed through the banks, the money spent by the borrowers comes back into the banks in the form of deposit accounts of those who have received this payment. It will increase the demand deposits of banks by Rs. 800.

- With new deposits of Rs. 800, banks keep 20% as cash reserves and lend the balance Rs. 640. Borrowers use these loans for making payments, which again comes back into the accounts of those who have received the payments. This time, banks deposits rise by Rs. 640. The deposit keep on increasing in each round by 80% of the last round deposits, At the same time, cash reserves also go on increasing, each time by 80% of the last cash reserve. Deposit creation comes to end when total cash reserves become equal to the initial deposit.

CENTRAL BANK

Central Bank is an ‘Apex’ body that controls, operates, regulates and directs the entire banking and monetary structure of the country.

It is known as the apex (supreme) as it occupies the top most position in the monetary and banking system of the country.

FUNCTIONS OF CENTRAL BANK

Central Bank is an ‘Apex’ body that controls, operates, regulates and directs the entire banking and monetary structure of the country.

It is known as the apex (supreme) as it occupies the top most position in the monetary and banking system of the country.

FUNCTIONS OF CENTRAL BANK

(I) Currency Authority Bank of Issue :

Central Bank has the sole authority for issue of currency in the country. In India, Reserve Bank of India (RBI) has the sole right of issuing paper currency notes (except one-rupee notes and coins, which are issued by Ministry of Finance).

All the Currency issued by the Central Bank is its monetary liability, i.e. Central Bank is obliged to the bank the currency with assets** of equal value, to enhance the public confidence in paper currency.

These Assets usually consist of gold coins, gold bullions, foreign securities and domestic governments local currency securities.

Advantages of Sole Authority of Note issue with RBI (i) It leads to uniformity in note circulation.

- It gives the central bank power to influence money supply because currency with public is a part of money supply.

- It enables the government to have supervision and control over the central bank with respect to issue of notes.

- It ensures public faith in the currency system.

Central Government is also authorised to borrow money from the Central

Bank When government incurs a deficit in its budget, it borrows from

Central Bank by selling its treasury bills. When Central Bank acquires

these securities, it issues new currency. This is known as ‘Moneitizing the Government’s Debt’ or ‘Deficit Financing’.

(II) Banker to the Government

The Reserve Bank of India acts as a banker agent and a financial advisor to the Central Government and all the State Governments (except that of Jammu and Kashmir).

- As a banker, it carries out all banking business of the government.

- It maintains a current account for keeping their cash balances.

- It accepts receipts and makes payments for the government and carries out exchange, remittance and other banking operations.

- It also gives loans and advances to the government for temporary periods. The government borrows money by selling treasury bills to the Central Bank.

- As an agent, the central bank also has the responsibility of managing the public debt.

- As a financial advisor, the central bank advises the government from time to time on economic, financial and monetary matters.

Banker’s Bank and Supervisor

There area number of commercial banks in a country. There should be some agency to regulate and supervise their proper functioning. Being the apex bank, the central bank (RBI) acts as the banker to other banks. In this sense, it bears the same relationship with commercial banks as the latter maintains with the general public.

As the banker to banks, the central bank functions in three capacities:

- Custodian of Cash Reserves : Commercial banks are required to keep a certain proportion of their deposits (known as Cash Reserve Ratio or CRR) with the central bank. In this way, central bank acts as a custodian of cash reserves of commercial banks.

- Lender of the Last Resort : When commercial banks fail to meet their financial requirements from other sources, they approach the central bank to give loans and advances as lender of the last resort. Central bank assists these banks through discounting of approved securities and bills of exchange.

- Clearing House : As central bank holds the cash reserves of all the commercial banks, it becomes easier and more convenient for it to act as their clearing house. All commercial banks have their accounts with the central bank. Therefore, the central bank can easily settle claims of various commercial banks against each other, by making debit and credit entries in their accounts.

As a supervisor, central bank regulates and controls the commercial banks. The regulation of banks may be related to their licensing, branch expansion , liquidity of assets, management, merging, winding up etc. The control is exercised by periodic inspection of banks and the returns filed by them.

CONTROLLER OF MONEY SUPPLY AND CREDIT

As RBI has the sole monopoly in currency issue, it can, control credit and supply of money. For this, RBI makes use of following methods of credit control.

- Reply (Repurchase) Rate : Repo rate is the rate at which the central bank of a country (RBI in case of India) lends money to commercial banks to meet their short-term needs. The central bank advances loans against approved securities or eligible bills of exchange.

An increase in repo rate increases the cost of borrowings from the central bank. It forces the commercial banks to increase their lending rates, which discourages borrowers from taking loans. It reduces the ability of commercial banks to create credit. A decrease in the repo rate will have the; opposite effect.

- Bank Rate (or Discount Rate) : Bank rate is the rate at which the central bank of a country (RBI in case of India) lends money to commercial banks to meet their long-term needs. RBI has been actively using Bank rate to control credit. Bank rate has the same effect as that of Repo rate, i.e. an increase in Bank rate increases the cost of borrowings from the central bank, which leads to increase in lending rates by commercial banks. It discourages borrowers from taking loans, which reduces the ability of cormnercial banks to create credit.

Repo Rate Vs Bank Rate

Repo rate and Bank rate are almost similar except the following difference : Repo rate is applicable to short- term lending by the central bank and is governed by the short-term interest rate. On the other hand. bank rate is applicable to long-term lending by the central bank and is governed by the long-term interest rate.

Note : Reverse Repo Rate

Reverse Repo rate in the rate at which Reserve Bank of India (RBI) borrows money from commercial banks.

- RBI makes use of this fool when it feels that there is excess money supply in the banking system.

- Banks are always happy to lend money to RBI as their money is in safe hands with a good interest.

- An increase in Reverse repo rate induces the banks to transfer to RBI due to attractive interest rates.

3. Open Market Operations : Open market operations (OMO) refers to buying and selling of government securities by the Central Bank from/to the

public and commercial banks. RBI is authorised to sell or purchase treasury bills and government securities. It does not matter whether the securities are bought or sold to the public or banks because ultimately the amounts will be deposited in or transferred from some bank.

- Sale of securities by central bank reducese reserves of commercial banks. It adversely affects the bank’s ability to create credit and therefore decrease the money supply in the economy.

- Purchase of securities by central bank increases the reserves and raises the bank’s ability to give credit.

4. Legal Reserve Requirements : (Variable Reserve Ratio Method) : According to Legal reserve requirements, commercial banks are obliged to maintain reserves. It is a very quick and direct method for controlling the credit creating power of commercial banks. Commercial Banks are required to maintain reserves on two accounts.

- Cash Reserve Ratio (CRR) : It refers to the minimum percentage of net demand and time liabilities, to be kept by commercial banks with the central bank. A change in CRR affects the ability of commercial banks to create the credit. For instance, an increase in CRR reduces the excess reserves of commercial banks and limits their credit creating power.

- Statutory Liquidity Ratio (SLR) : It refers to minimum percentage of net demand and time liabilities which commercial banks are required to maintain with themselves. SLR is maintained in the form of designated liquid assets such as excess reserve.

5. Margin Requirements : Margin is the difference between the amount of loan and market value of the security offered by the borrower against the loan. If the margin fixed by the Central Bank is 40%, then commercial banks are allowed to give a loan only up to 60% of the value of loan made against y security. By changing the margin requirements, the Reserve Bank can alter the amount of loans made against securities by the banks.

- An increase in margin reduces -the borrowing capacity and money supply.

- A fall in margin encourages the people to borrow more

Credit Control Instruments of RBI : Quantitative Vs Qualitative instruments The central bank (Reserve Bank of India) controls credit through the various methods, which are also categorised as ‘Quantitative’ and ‘Qualitative’ methods :

- Quantitative methods include repo rate policy bank rate policy, open market operations, varying reserve requirements. Qualitative methods include margin requirements, moral suasion, selective credit controls.

- Quantitative instruments are general in nature and it affects all the sectors making use of bank credit. However, qualitative instrument are specific in nature, i.e. they affect the flow of credit for a particular use.

- Quantitative controls are designed to regulate the total volume of credit, whereas, qualitative controls are designed to regulate the direction of credit.

- Quantitative methods are also known as traditional methods of control and qualitative methods are also known as selective methods of control.

Custodian of Foreign Exchange Reserves

The central bank also acts as the custodian of the country’s stock of gold and reserves of foreign exchange This function enables the central bank to exercise a reasonable control on foreign exchange. According to regulations of foreign exchange, all foreign exchange transaction must be routed through RBI. Centralisation of foreign exchange transactions with the Reserve Bank serves two objectives :

- It helps the bank in stabilizing the external value of currency

- It helps in a pursuing a coordinated policy towards the balance of payments situation of the country.

HOTS

Q1. Differentiate between quantitative instruments of credit control and qualitative instruments of credit control. Rs. 5,000 crores Q2. Distinguish between demand deposits and fixed deposits.

Q3. Whether the following changes by the Reserve Bank will increase the money supply or decrease the money supply ?

- Rise in Bank rate

- Purchase of Securitiees in the open market.

- RBI increase the margin from 20% to 30%.

- RBI reduces the Cash Reserve Ratio.

Q4. The Reserve Bank of India aims to make the credit costly for hte general public in order to reduce the availability of credit. What should be done ? The reserve bank of India should increase the Bank rate. An increase in bank rate increases the costs of borrowing from the central bank. It forces the commercial banks to increase their lending rates, which discourages borrowers from taking loans. It makes the credit costly for the general public and reduces the availability of credit.

Q5. Calculate the value of money multiplier and total deposit created if initial deposit is of Rs. 500 crores and LRR is 10%. (Ans : 5000) Q6. Discuss the relation between bank rate and rate of interest.Bank rate is the rate at which the central bank lends to commercial banks and rate of interest is the rate at which commercial banks lend to their customers. Bank rate and rate of interest are directly related. If there is an increase in the bank rate, then commercial banks will have to pay more for the financial accommodation by the central bank. As a result, they would raise the rate of interest. Similarly, easy

availability of credit at a low bank rate would enable them to extend loans at reduced rate of interest.

Q7. State the advantages of centralised cash reserves with the Central Bank. The advantages of centralised cash reserves of commercial banks with the central bank are :

- This system results in effective utilization of the cash reserves of the country.

- It reinforces the confidence of public in the strength of the banking system of the country.

- It enables the central bank to control credit creation (done by commercial banks) by changing the cash reserve requirement.

- Commercial banks can get financial help from the central bank during temporary difficulties.

However, centralised reserve system is not favoured by commercial banks because it reduces their liquid funds and such reserves do not carry any interest.

TRUE AND FALSE

Are the following statements true or false ? Give reasons.

- Commercial banks do not create money.

Ans. False. Commercial banks add to the money supply by creating demand deposits.

- A reduction in bank rate adversely affects the lending power of commercial banks.

Ans. False. A reduction in bank rate makes the borrowing by banks from the central bank cheaper.

Thus, lending power of banks increases.

- Cash reserve ratio is fixed by the central bank.

Ans. True. Central bank has legal authority to fix the CRR.

- There is inverse relation between LRR and the size of money multiplier.

Ans. True. Money Multiplier = Money Multiplier = 1/LRR

- Purchase of securities by central bank reduces the casn reserves of banks.

Ans. False. Purchase of securities by central bank leads to flow of money into the economy. Thus, it increases the cash reserve of banks. To increase the money supply in the economy, central bank raises the CRR.

- Purchase of securities by central bank reduces the casn reserves of banks.

Ans. False. Purchase of securities by central bank leads to flow of money into the economy. Thus, it increases the cash reserve of banks.

- To increase the money supply in the economy, central bank raises the CRR.

Ans. False. If CRR is raised, lending power of banks will be reduced leading to decrease in money supply.

- Commercial banks create credit money.

Ans. True. Commercial banks create demand deposits in the process of giving loans.

- Reserve repo rate applies to the borrowing by the commercial banks.

Ans. False. Reverse repo rate applies to borrowing by the central bank from commercial banks.

- Bank rate is qualitative method of credit control.

Ans. False. Bank rate is a quantitative method of credit control, as it aims at influencing the volume of credit.

- Money created by the central bank of a country is high powered money.

Ans. True. The central bank has monopoly right to issue the legal tender money.